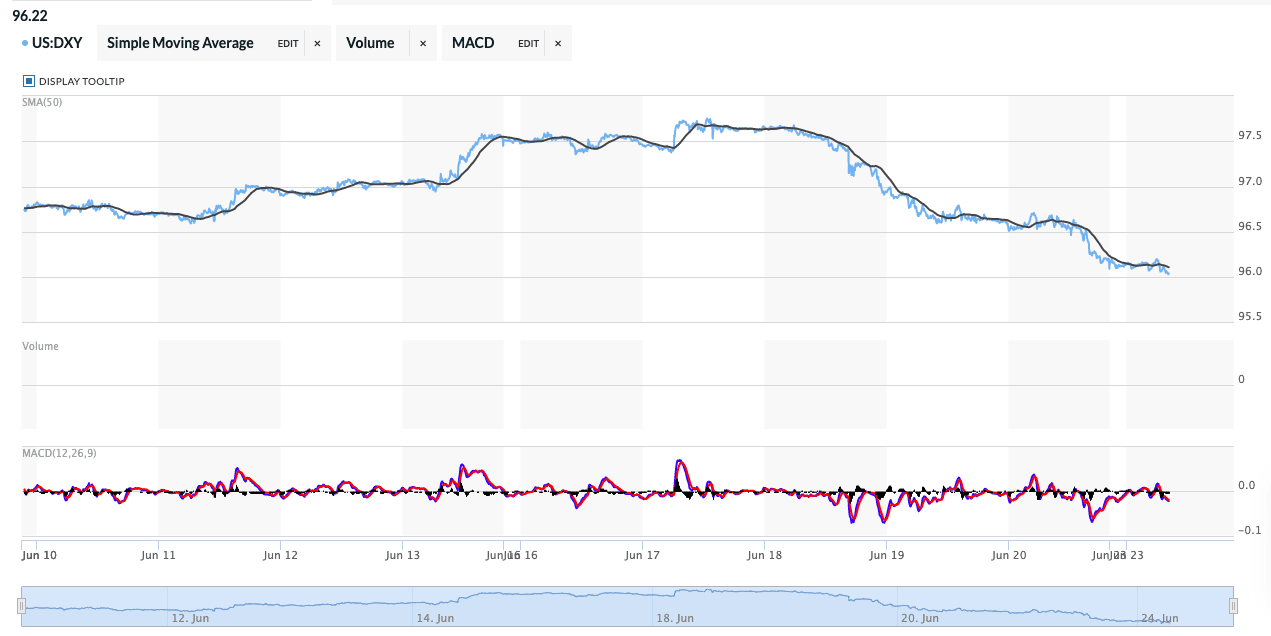

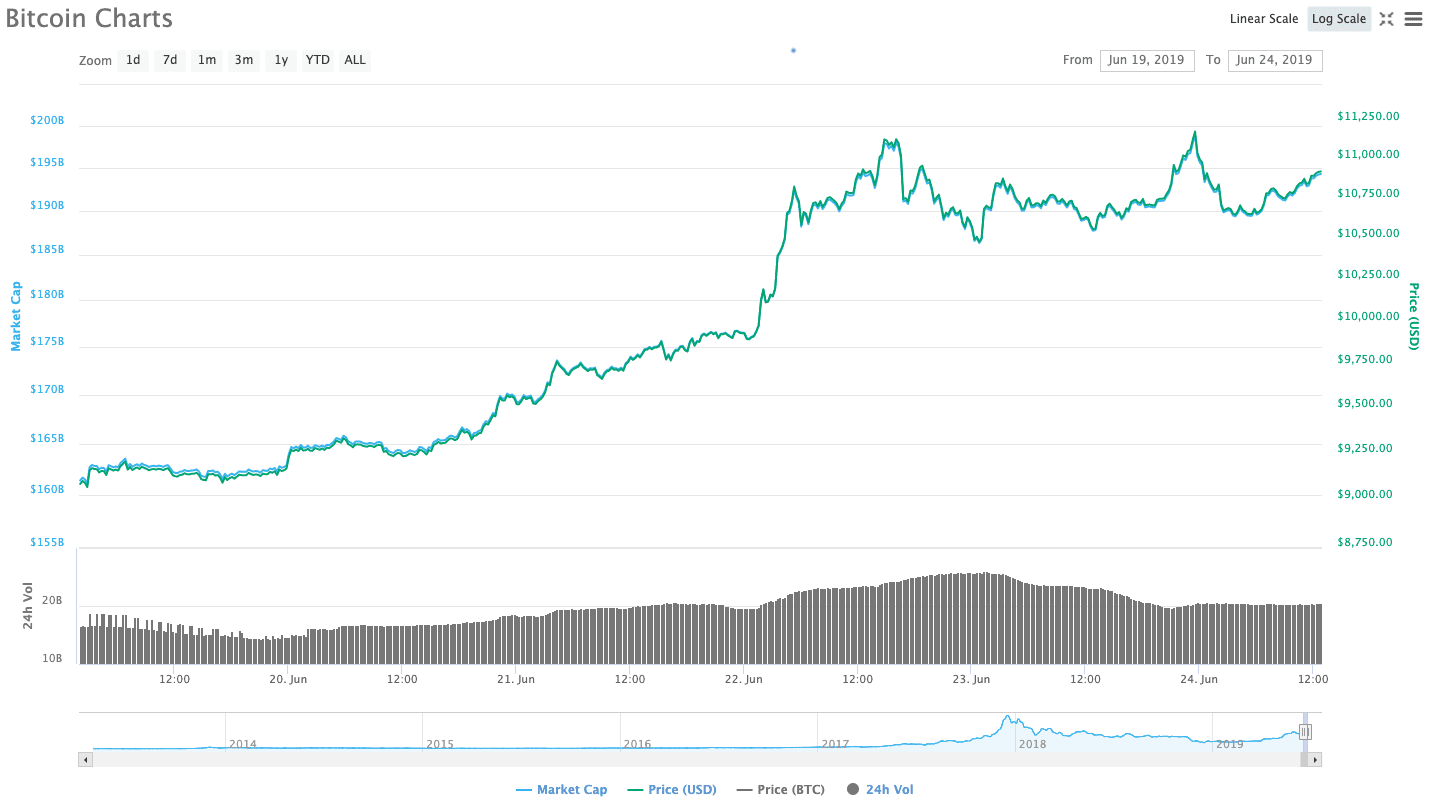

“Strong commodity (and cryptocurrency) prices, plus sharply falling US dollar hedging costs should keep the dollar on the soft side this week,” warned ING’s global head of strategy Chris Turner in his latest foreign exchange analysis. Turner’s right: the price of the DXY index – which measures the performance of the US dollar against a basket of international currencies – has struggled to find momentum moving into the new week of trade. Turner highlighted a few factors that could influence a USD downturn. Jerome Powell, chairman of Federal Reserve’s board of governors, is set to deliver a speech on policy tomorrow, which is likely to make traders nervous. The US is also set to update the personal consumption expenditure (PCE) deflator (a statistic for the US’ gross product spending) on Friday. Turner remarked another low reading after last year’s could “worry the Fed.” President Donald Trump is also scheduled to meet China’s leader Xi Jinping on Friday and Saturday during the upcoming G20 summit in Japan. USD market participants could turn tentative as these events unfold, if they aren’t already. Turner posited these reasons, plus reduced costs to hedge against the USD (a term for offsetting risk by investing in assets with negative correlations), should keep DXY action relatively slow in the short term. ING’s analysis comes as Bitcoin posts stellar gains. Just after its blockchain set a new record for highest hash rate, the price of Bitcoin rushed past $10,000 to briefly pierce $11,000.

— Jameson Lopp (@lopp) June 22, 2019 At pixel time, BTC trades at around $10,900 — up around 17 percent in the past seven days.