Often pegged as a primary Tesla rival, NIO is today worth almost $66 billion, making it the sixth most valuable carmaker in the world ahead of major marquees like US’ General Motors and Germany’s BMW. On the other hand, Elon Musk’s wunderstock Tesla is still number one, having eclipsed Toyota earlier this year.

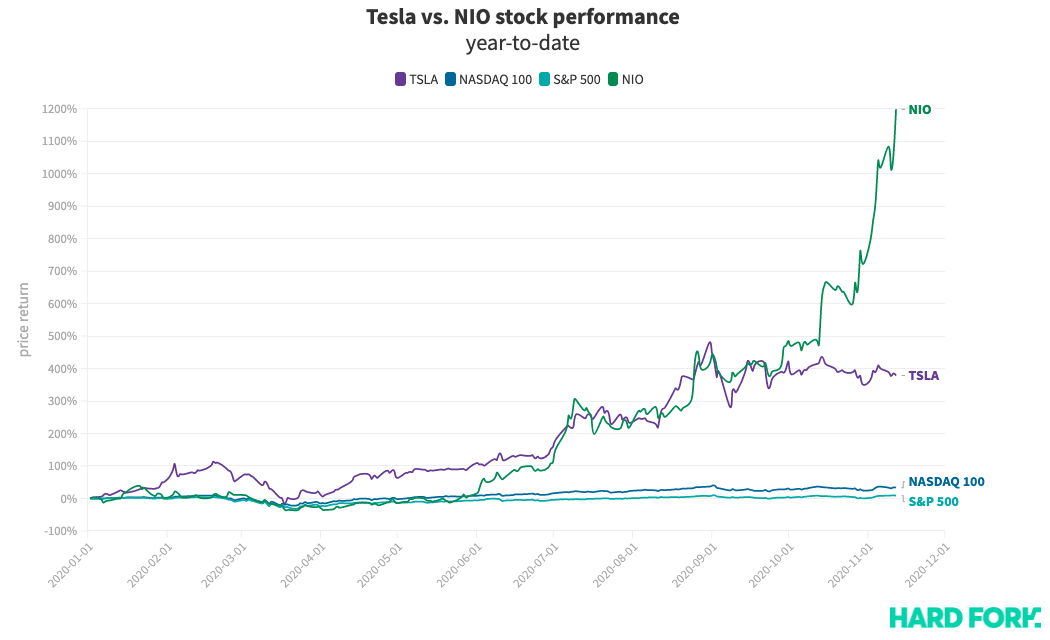

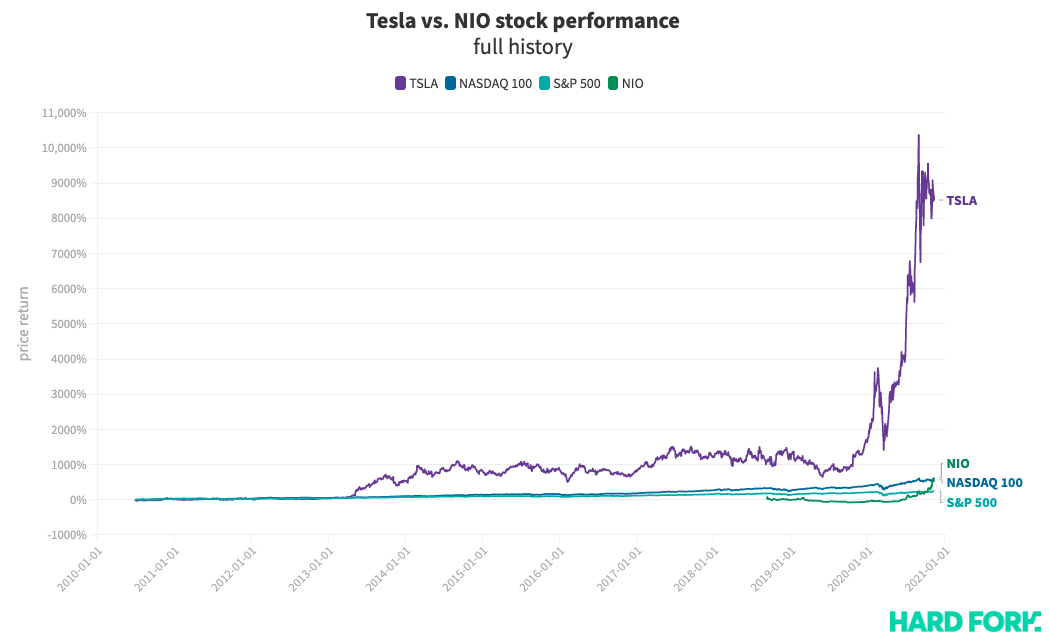

But while Tesla has impressively returned nearly 400% this year, its 2020 returns seem small compared NIO’s. In the 10 years since Tesla’s IPO, the company’s stock has risen by up to 10,500% at its peak, and more than 8,500% at today’s prices. Zoom out and it’s clear just how far NIO has to climb to truly compete with Tesla’s returns. [Read: Watch Tesla’s meteoric rise — set to techno-remixed Elon Musk tweets]

NIO’s share price actually spent most of its time since its US IPO in 2018 in the red. In fact, it was only in June that the company’s stock turned positive since its listing on the New York Stock Exchange. NIO stock has now returned more in two years than the tech-heavy NASDAQ 100 index has in the past 10. (If the visualization above doesn’t show, try reloading this page in your browser’s “Desktop Mode.”) Indeed, NIO’s success is remarkable. As Bloomberg noted, the company was in dire straits before consumer and market sentiment shifted from skepticism to opportunism. Bloomberg highlighted a $1 billion investment led by a Chinese municipal government in June as a key trigger for NIO’s turnaround.